One of the six Credit Factors on Credibble’s 24-Factor Credit Check is based on your credit activity. This includes all the credit agreements you currently have, and any hard credit searches in the past six months.

What's Included?

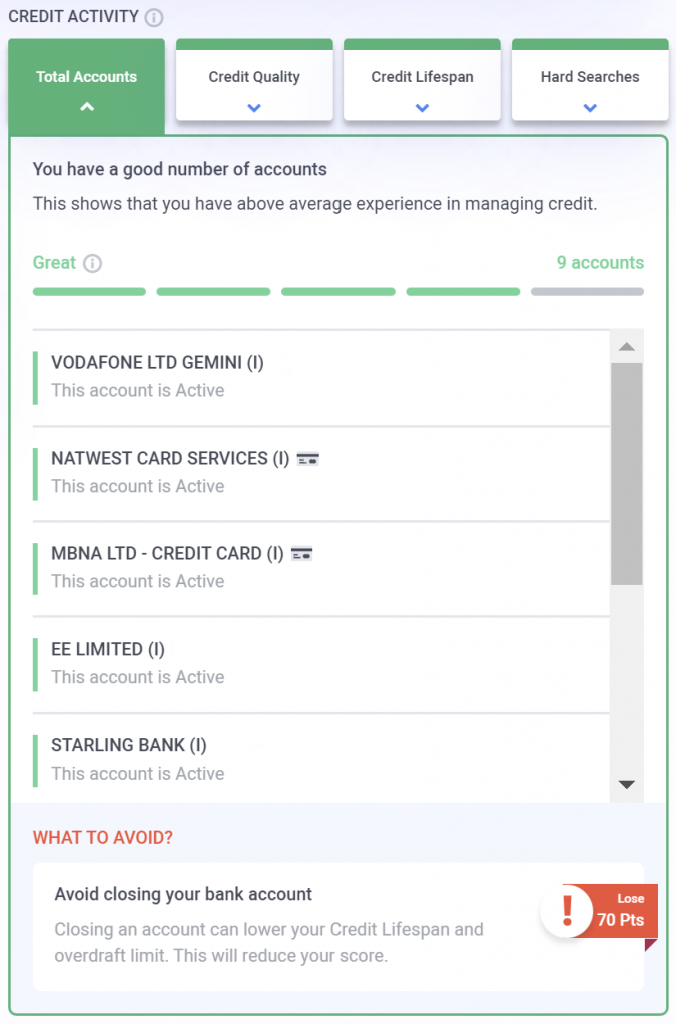

Total Accounts

This is your total number of accounts – credit or non-credit – from companies that report to the main credit reference agencies. For example your current account counts for one, your mobile phone contract counts for another. Any outstanding loans you may have will also count. The more of these agreements you have, the better lenders see you.

Lenders like to see several different accounts in total, because it means you are able to manage different forms of credit. It also shows that multiple institutions trust you as a borrower. This gives lenders the confidence to lend to you. If you have ten or more accounts in total, lenders will take this as a good sign that you can manage one more.

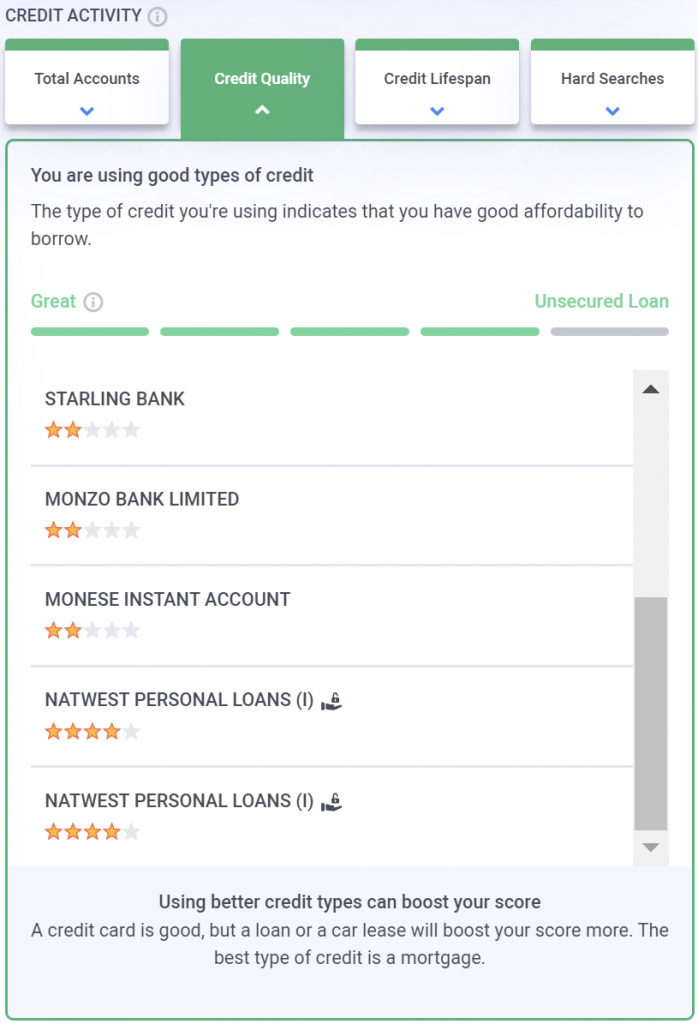

Credit Quality

It’s not just a numbers game. Lenders also want to see you holding multiple different types of credit. Different types of credit have varying levels of impact on your credit quality. This impact can be positive or negative. Payday loans, for example, have the biggest impact on your credit quality. However, they make a negative impact, because payday loans show that you are desperate for money. (See our article on Short-Term Credit for more on that.)

| Type of Loan | Type of Impact | |

|---|---|---|

| Highest Impact | Payday Loan | Negative |

| Mortgage, Secured Loan | Positive | |

| Unsecured Loan | Positive | |

| Credit Card | Positive | |

| Bills and Telecom | Positive | |

| Lowest Impact | Overdraft | Positive |

If you’re looking to borrow in the near future and you’ve had a payday loan recently, make sure you pay off the loan right away. Don’t apply for any more credit for at least three months. During this time, ensure you are keeping on top of your other credit arrangements. This maintains your credit quality and demonstrates your creditworthiness to lenders.

- ⭐ Our 24-Factor Credit Check goes beyond your credit score.

- ⭐ See your credit report through a lender’s eyes.

- ⭐ Personalised steps to improve your credit rating.

See… Fix… Borrow… with Credibble.

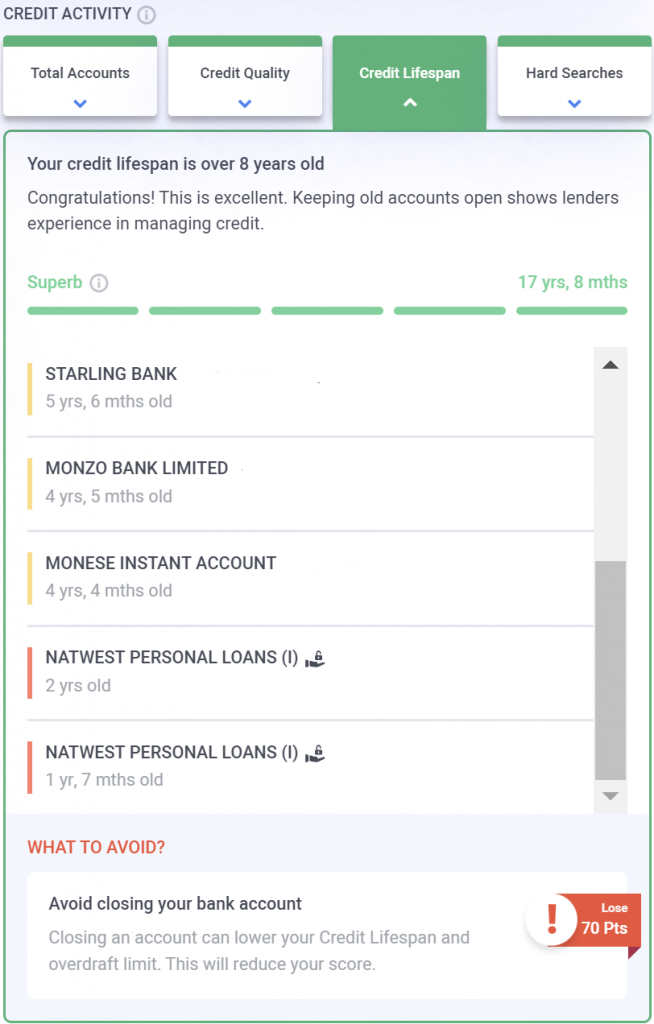

START FREE TRIALCredit Lifespan

Your credit lifespan is the age of your oldest account. In many cases, this will be your current account, but it can be other things. If you’ve had a bank account with an overdraft for several years, it’s best to avoid closing it. Lenders love to see years of experience in managing credit, so make sure you keep your oldest account open. If you close your oldest account, your credit lifespan is only as long as your next oldest account, which means you’ll lose years of experience on your record. Keep as many of your accounts open as you can. Seven years and older is the sweet spot!

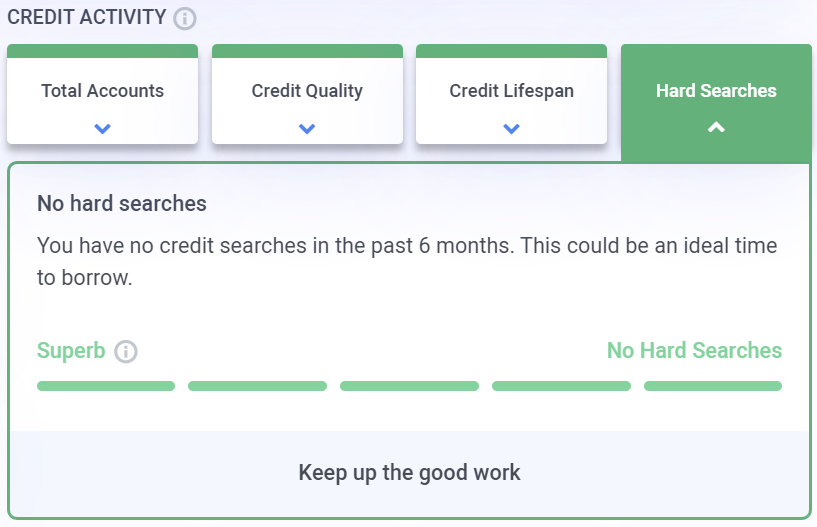

Hard Searches

You may be familiar with the terms “hard credit search” and “soft credit search” already, but in case you aren’t, here’s a quick explanation.

| Hard Searches | This is when a lender uses their internal system to look at your credit history and decide whether to lend to you i.e. when you apply for new credit The lender instantly informs the credit reference agencies, who go on to add a hard search marker to your credit report. This hard search will be visible to other lenders who look at your report, because it shows when and how often you are seeking to borrow money. Hard searches are only performed when you apply for credit. In fact, while not required by data protection law, it is considered best practice for lenders to get your consent for a hard search beforehand, to save legal headaches later on. When you take out a loan or a new lease, it will always involve a hard search. Too many hard searches in a short space of time sends the message that you’re desperate to borrow money. This is easier done than you might think. For example, if you apply for credit from Lender A, and then a week later apply for credit from Lender B, Lender B will see a hard search from Lender A. Now, Lender A might still be processing your application, but to Lender B, it looks like Lender A turned down your application. This obviously looks bad, and so Lender B may reject your application. Seems unfair, but remember, it’s about risk, not your actual circumstances. Try to space out your credit applications to avoid rousing suspicions. Better still, if you sign up with Credibble, we can tell you when best to borrow depending on your unique circumstances. |

| Soft Searches | When you have your credit file searched for purely informational reasons, such as for a quote or to get a credit score, this is a “soft search”. Soft credit searches do appear on your file, but they’re only visible to you, not to others. This is because you’re not actually applying for credit, you’re just trying to find out information about your credit report, such as your creditworthiness. It would hardly be fair if every time you logged into Credibble, it lowered your credit score! Our 24-Factor Credit Check uses Soft Search Technology, so our credit tools never leave a hard search stain on your report. |

Credibble offers two fabulous solutions

If you’re preparing to take a mortgage, never apply until you’ve tried our unique and FREE Credibble Home app. Our smart technology will tell you what you need to fix so you avoid rejection. The app predicts when you will be able to buy, for how much and tracks your month-by-month progress to mortgage success. We’ve even added your own mortgage broker, so you get the best deals available.

More focused on your credit rating? Well, get started for free with Credibble’s 24- Factor Credit Check to truly help you improve your creditworthiness and how lenders view you. (Remember: lenders don’t use your credit score! We’ll show you what lenders look for and how to get your credit report in the best shape possible).