One of the six factors on your lender report is centred around the credit cards you hold. This is split into four sections: Credit Card Usage, Total Limit, Exceeding Limits, and Cash Withdrawals. You get a rating for each section, and together they assess how you use your credit cards. Don’t be thrown if you don’t have a credit card; it’s useful to know what you’ll be judged on if you’re looking to get one soon.

What's Included?

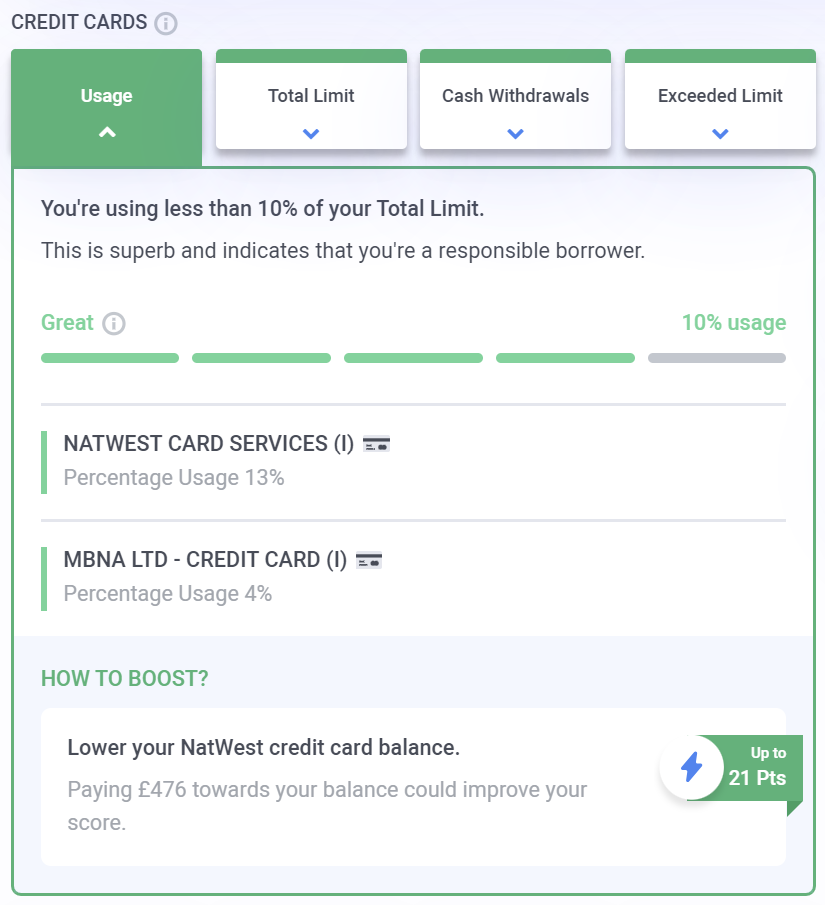

Credit Card Usage

On your 24-FCC, Credit Card Usage is presented as a percentage. It is the total you have spent on all of your credit cards against the total of your credit card limits (total limit). Let’s say you have a balance of £100 on a credit card with a limit of £500, and £200 spent on a second credit card with a limit of £500. Overall, your usage is £300 from a total limit of £1000: that’s 30%. It’s that simple! Try and keep your credit card usage below 10% for the best rating.

- ⭐ Our 24-Factor Credit Check goes beyond your credit score.

- ⭐ See your credit report through a lender’s eyes.

- ⭐ Personalised steps to improve your credit rating.

See… Fix… Borrow… with Credibble.

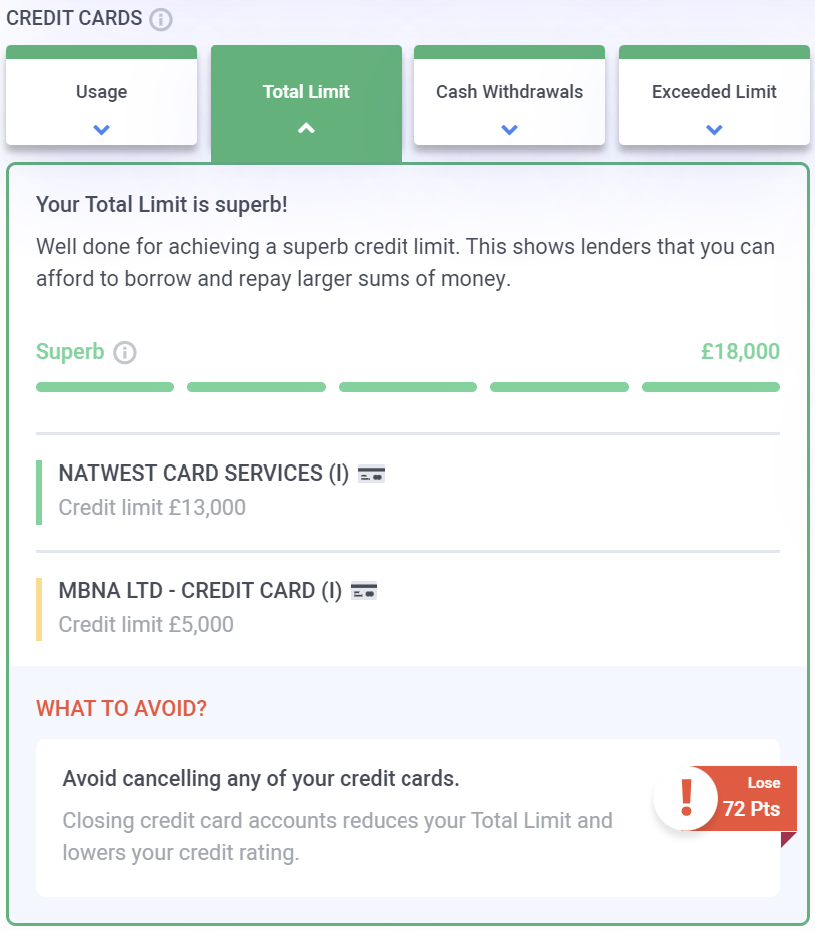

START FREE TRIALTotal Limit

It is a common misconception that having a lower credit limit means your credit rating will be higher. In reality, the higher your credit limit, the better. Take our previous example of using £300 of a Total Limit of £1000 – if you changed this to £500 of a £5000 total limit, then you are using 10% of the credit available. Despite having more debt on the credit card, you are using a smaller percentage of your total limit.

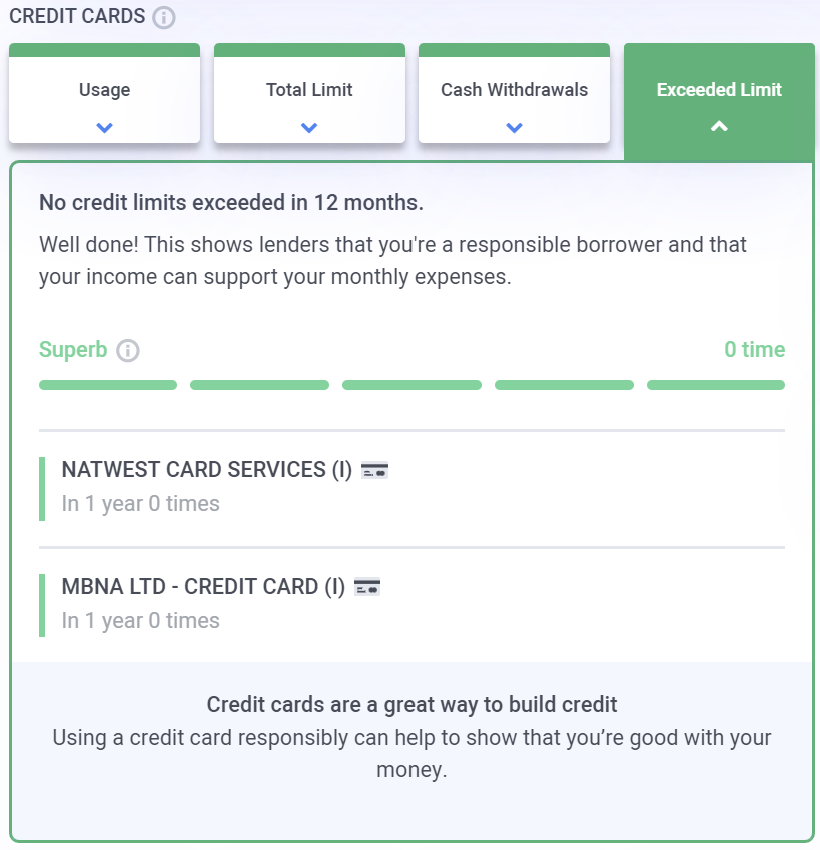

Exceeding Limits

Spending over the individual credit card limits damages trust with current and potential lenders. Doing so could lose you a promotional interest rate, give you some hefty charges, and have a detrimental impact on your Credibble Score.

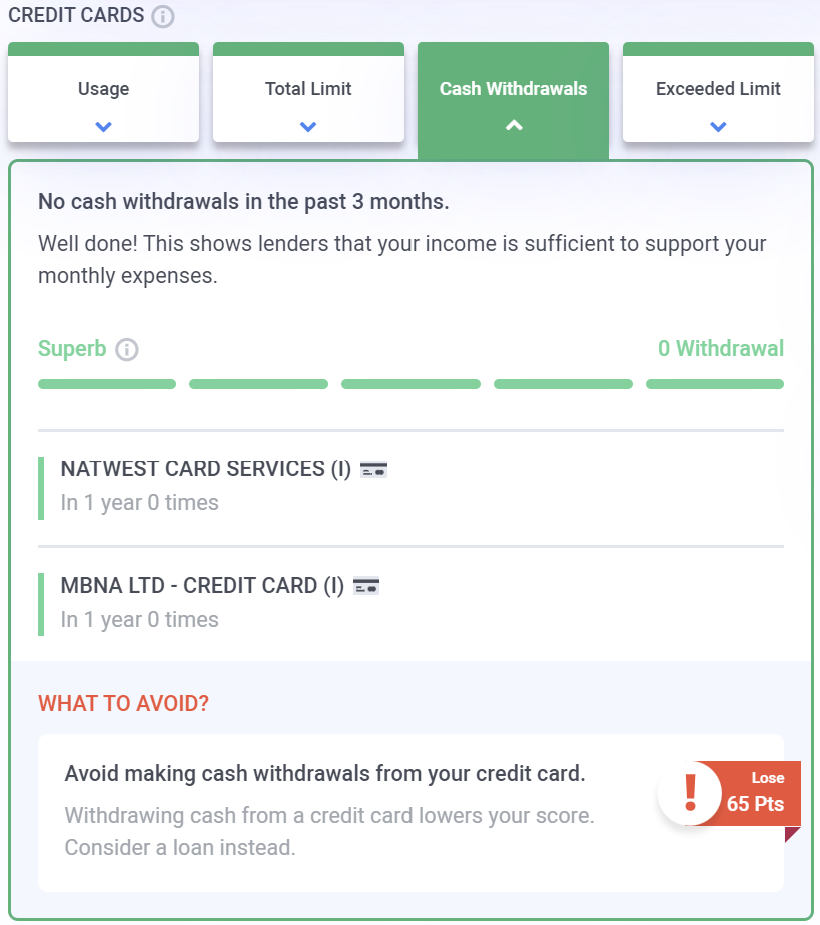

Cash Withdrawals

You might think that withdrawing cash on a credit card is the same as withdrawing cash on a debit card, but unfortunately, you couldn’t be more wrong. It suggests desperation for money, and that you’ve exhausted other sources, such as your current account, overdraft, and any savings. Cash withdrawals put a significant dent in your creditworthiness and hence your Credibble Score. Best to avoid.

Alongside the result on your Credibble Score, withdrawing cash on a credit card racks up heavy fees. If you’re short of cash, try dipping into your overdraft instead. It’s not ideal, but it won’t have such a negative impact on your credit rating, and the fees are generally much lower.