What's Included?

What is a Notice of Correction?

A Notice of Correction is a short statement of up to 200 words that goes on your credit report. You can write it in order to explain the reason behind a bad indicator in your credit history.

Usually, the purpose of this note would be to prevent a possibly misleading impression regarding your creditworthiness that these indicators can give lenders. For example, you may have a default or IVA as a result of a major incident or lifestyle change you’ve experienced, like health problems or losing your job.

Does a Notice of Correction damage my credit score?

No. A Notice of Correction alone does not damage or improve your credit score in any way. However, an arrears status on your credit file, will most likely negatively impact your credit score and your chances of approval.

How will it help me?

A NOC can help you explain a financially unstable period in your life. Usually, one that was due to circumstances out of your control. It can also help you to manage your financial situation and obstruct you if you have a tendency to take on more debt than you can handle.

If you have a NOC, lenders will refer to it to make a decision whenever you apply for new credit. This means that banks or credit providers will manually handle any new applications you make. The application process will, however, most likely be slowed down by this.

How to add or remove a Notice of Correction?

At Credibble, we can’t add the note to your credit file for you. If you want to raise a Notice of Correction, you can get in touch with Equifax. Click here to do so by filling in a form on their website. Please note that your statements must be appropriate, correct and not harm the reputation of companies or individuals.

In the event that you wish to remove the Notice of Correction, you can do so by contacting Equifax’s Customer Support on 0800 014 2955 (Mon-Fri, between 9am – 5pm). You have to allow time for your credit report to get updated.

How can I see if I’ve got bad credit on my credit report?

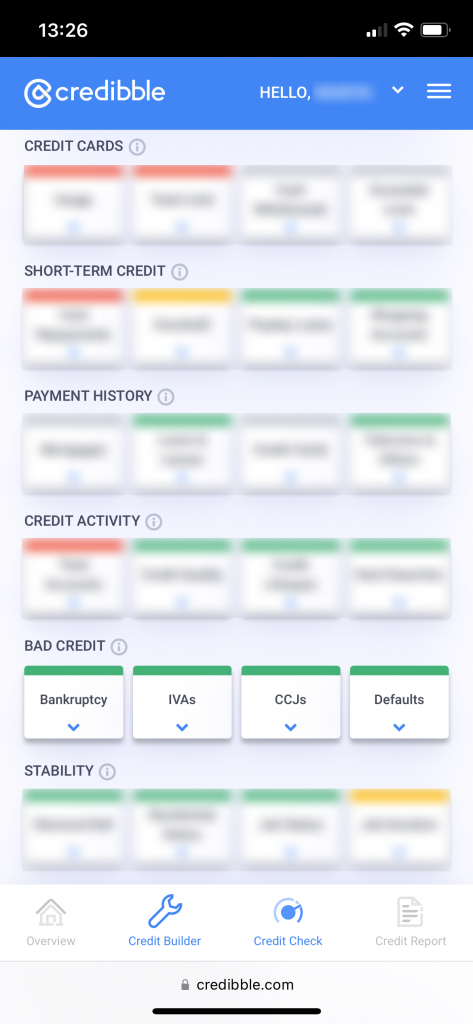

You can easily check the health of your credit history with Credibble’s 24-Factor Credit Check™. We check your credit report for any sign of defaults, CCJs, IVAs or bankruptcy.

Sign up for Credibble here and get your full credit report.

Credibble offers two fabulous solutions.

If you’re preparing to take a mortgage, never apply until you’ve tried our unique and FREE Credibble Home app. Our smart technology will tell you what you need to fix so you avoid rejection. The app predicts when you will be able to buy, for how much and tracks your month-by-month progress to mortgage success. We’ve even added your own mortgage broker, so you get the best deals available.

More focused on your credit rating? Well, get started for free with Credibble’s 24- Factor Credit Check to truly help you improve your creditworthiness and how lenders view you. (Remember: lenders don’t use your credit score! We’ll show you what lenders look for and how to get your credit report in the best shape possible).