There isn’t a specific electoral roll credit score. However, being on the electoral roll can influence your credit score/rating.

Taking certain steps can improve your credit rating and increase the credit you may be eligible for. One such step is getting on the electoral register, an important tool for anyone pursuing a loan, mortgage, credit card, mobile phone contract, or other financial obligations.

What exactly is the electoral register, what happens if you’re not registered, and how do you get on it? These are just some of the questions we’ll tackle as we delve into this topic. And, as an added bonus, we’ll explore the fascinating ways that the electoral register can shape your credit score. So, prepare to be informed!

What's Included?

What is the Electoral Register?

The Electoral Register, or the Electoral Roll as it’s commonly known, is a vital list of names and addresses of individuals authorised to vote in various public elections held in the UK and Northern Ireland. It also extends to referendums, ensuring that bona fide voters have their voices heard. Constituencies are established based on the information captured, which includes eligible voters’ names, addresses and electoral numbers.

But wait, there’s more! The Electoral Roll also comes in handy for several other purposes, including criminal investigations and selecting people for jury duty. Credit applications use this data to confirm identities and addresses, thereby thwarting identity theft.

Intriguingly, the Electoral Register isn’t solely for the government’s eyes. An “open” or “edited” register contains identical information to the main register. Nonetheless, unlike the official list, it’s available for purchase by various businesses, organisations, and charities. You can request that your details be eliminated from this list or choose the option when registering.

Remember, the full Electoral Register is published annually, and your local electoral registration office, located in your local council buildings, maintains the register and updates it every month.

Am I on the Electoral Roll?

One way to confirm your registration in the electoral register is to reach out to your local Electoral Registration Office. Not sure where that is? Just click over to the Electoral Commission’s website, pop in your postcode and you’ll immediately connect with your local Electoral Services office. There, you’ll even get an email you can use if you want to enquire about your voter registration. Keep in mind: your details will only be public on the voter registry if you requested this access when registering.

Am I able to vote?

Did you know that the legal age for voter registration is different depending on which country of the UK you reside in? If you are from England or Wales, you can register to vote starting at the age of 16. In contrast, if you reside in Scotland or Northern Ireland, the legal age for voter registration starts at 14 and 17 years of age, respectively.

But hang on, that’s not all. To be eligible to vote, you must also meet specific citizenship criteria. Qualifying candidates for the voter registration process are either British or Irish citizens, qualifying Commonwealth citizens living in the United Kingdom, or EU citizens residing in the United Kingdom. And of course, you have to be at least 18 years old to cast your vote! Unless, of course, you are from Scotland, where some elections offer the option of voting from the young age of 16.

Now, if you’re like some of the 9.4 million people in the UK who are currently eligible to vote but are not registered to vote correctly, then you should consider doing so as soon as possible. Why? Because if you are asked to register to vote, and you don’t, you could end up with a hefty fine. However, you won’t be fined if you’ve got a legit reason for not responding to the request (like you have been abroad or in the hospital). To combat the lack of voter registration, the Electoral Reform Society actively campaigns to get as many people registered to vote as possible while championing the rights of voters.

How to get on the Electoral Register

If you’re unsure whether you’re on the electoral register, fear not! Simply contact your local electoral office – they’ll have the answers you need.

But if you already know you’re not on the register, it’s super easy to get started. The good news is, you can apply for registration on GOV.UK’s website by simply filling out a quick form using your National Insurance number and other basic deets, like your address and name.

Signing up to the electoral roll might just be one way to help bump up your credit score. But remember, being proactive and paying bills on time and taking extra measures to safeguard your financial information are key to making the most of your finances!

How does the Electoral Roll affect credit scores?

The electoral register can do wonders for your credit score. Want to know why? Simply put, it provides interested parties with the reassurance that you are the real deal and that the details you’ve provided are on point.

Why does this matter? Well, think about it. Lenders must verify your identity to prevent identity theft and fraud, so the more information they can get, the more likely they are to lend you money. And checking whether you’re on the electoral register is one of the easiest ways to boost your credit score.

But why wouldn’t you be on the register in the first place? From moving around too often to just plain laziness when it comes to politics, there could be many reasons why you’re not registered to vote. But hey, that’s okay. The electoral register is still one of the most reliable ways to verify your identity.

So if you want to ensure that your credit score accurately reflects your financial history, ensure your details are up-to-date on the electoral register. It may just be the key to unlocking better credit.

How Many Credit Points For Being On Electoral Register?

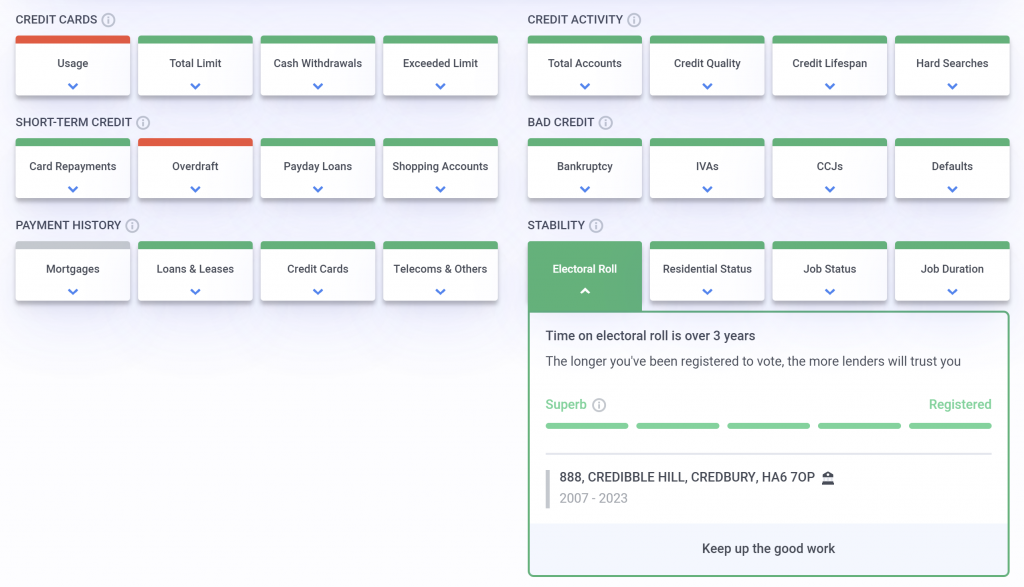

Credit ratings are influenced by multiple factors, where a single factor in one person’s report may not hold the same value for another. Credibble’s smart 24-Factor Credit Check lets you know if you are registered to vote and if it is reported on your credit history. If you are confident that you are on an electoral roll but can’t see it on your credit report, it’s imperative to resolve this – as you might be losing valuable credit points! First, check if you are registered, then contact Equifax directly to get it sorted pronto. Remember, the higher your credit rating, the better your financial health!

Why not take a free spin with a 30-day no-charge trial? See where you stand for all your factors – you’ll get personalised actions on how to improve.

6 Great Reasons To Get On The Electoral Roll

Greetings! Did you know that registering to vote has some fascinating benefits that you may not have known about? Here are the top six reasons why you should register to vote:

Firstly, registering to vote can improve your credit score! Yes, you heard it right. Your Experian Credit Score, which determines your approval chances by lenders for things like a mortgage, loan, or mobile phone contract, is based on information in your credit report. Your electoral details are recorded on your credit report when you register to vote, which helps lenders to confirm your name and address. This, in turn, increases your credit score. You can check your Experian credit score for free anytime with a free Experian account.

Secondly, registering to vote can save you time on credit applications. If lenders cannot confirm your details through the electoral roll, they may need to ask for other forms of identity, which can delay your application. But registering to vote beforehand can save you much time in the long run.

Third, registering to vote lets you access various services more easily. Lenders aren’t the only organisations that use your electoral information to identify you. Registering to vote can also facilitate easier access to insurance, legal, accounting, and public services such as obtaining a passport.

Fourth, by registering to vote, you can have your say in local and general elections, allowing you to influence their outcome.

Fifth, registering to vote at your current address can help safeguard you from identity theft and fraud.

Finally, some employers, especially those in the financial sector, will use the electoral roll to check your details when you apply for a job. By registering to vote, you might find job applications easier to complete.

Overall, if you were wondering ‘does voting increase credit score’, the simple answer is yes. However, there are many other benefits.

- ⭐ Our 24-Factor Credit Check goes beyond your credit score.

- ⭐ See your credit report through a lender’s eyes.

- ⭐ Personalised steps to improve your credit rating.

See… Fix… Borrow… with Credibble.

START FREE TRIALThe Electoral Register – Before getting on it

Here are some helpful things to keep in mind before registering to vote:

Ways to register: To get on the electoral roll in England, Scotland and Wales, you can register via post or online. Keep an eye out for the Household Enquiry Form from your local council, which should come in the post between July and November each year to ensure your current registration details. Meanwhile, you’ll need to fill out and return a voting registration form in Northern Ireland.

Best address to register: If you live in temporary accommodation, such as student halls or barracks, consider registering at a permanent address, such as your parents’ home, to reduce the risk of identity theft. This can also help your credit score, as lenders don’t favour multiple addresses over a short span of time. Although you can register in multiple places, you can only vote once in each election.

Registering details: Once you’ve registered to vote, your electoral details should automatically appear on your credit report within 30 days. Remember that a few exceptions apply, such as if you’ve registered during the annual canvass, which runs from August to November. In such cases, credit bureaus like Equifax only reflect this on your credit report from 1st December. If you can’t supply a regular UK address when you register, they can’t process your electoral data automatically. But don’t worry – you can always reach out directly. Finally, if you live in Guernsey, credit bureaus can’t access electoral information about you. However, feel free to contact Equifax to update your report to show you’re registered to vote manually.

Requirements:

- At least 18 years old on the day of the voting

- Either a British, Irish, or a qualifying Commonwealth citizen

- Based in the UK OR a UK citizen living abroad who has registered to vote in the UK within the last 15 years, and

- Not legally excluded from voting (e.g., members of the House of Lords, convicted prisoners)

If you don’t register to vote, processing your requests for credit and other services might take longer, and you may be rejected. An alternate option is to attach an explanatory note to your report describing why you can’t register to vote and providing lenders assurance that you hold papers confirming your home address and duration of stay there. You can do this directly with Equifax.

Frequently Asked Questions

1. Does being on the electoral roll affect credit score?

Yes, being on the electoral roll can positively impact your credit score. Registering to vote, your electoral details are recorded on your credit report. Lenders use this information to confirm your name and address when you apply for credit. It also helps them to combat fraud by verifying your identity 1.

2. Do lenders check electoral roll?

Yes, lenders check the electoral roll as it helps them verify your identity and address when you apply for credit 1.

3. Does voting in UK increase credit score?

No, voting in the UK does not increase your credit score directly. However, being on the Electoral Roll can help improve your credit rating as it shows lenders that you are settled and stable at your current address 1.

4. How long does it take for electoral roll to show on credit file?

The electoral roll can take up to two months to show on your credit file 1.

5. Does being on the electoral roll affect council tax?

No, being on the electoral roll does not affect council tax 1.

6. What is the difference between electoral roll and electoral register?

The electoral roll and electoral register are the same thing. The electoral roll is a list of all eligible voters in an area. In contrast, the electoral register lists all eligible voters in an area who have registered to vote 2.

7. Is it compulsory to be on the electoral register?

Yes, being on the electoral register is compulsory if you are eligible to vote 2.

8. Is it important to be on the electoral register?

Yes, being on the electoral register is important as it allows you to vote in elections and referendums. It also helps improve your credit score by showing lenders that you are settled and stable at your current address 2.

9. Is there an electoral roll credit score?

There isn’t an electoral register credit score, but being on they Electoral roll has a positive impact on your credit rating 7.

10. Should I opt out of open register or is it good to be on the open register?

A frequent debate, ‘Should I opt out of the open register?’ or ‘Should I be on the open register?’. Opting out does not affect your right to vote. When you opt out of the open register, your details will still appear on the full version of the electoral register 2. Being excluded from the Open Register simply means that your details are not available to purchase for marketing purposes. Wondering about the benefits of being on the open register? More marketing!

11. How much does electoral roll affect credit

Being on the electoral roll can help improve your credit score as it confirms your name and address. Lenders use this information to confirm your identity and address when you apply for credit. However, being on the electoral roll is just one factor that lenders consider when assessing your creditworthiness8,10.

12. Does not voting affect your credit score

No. Voting has no impact on your credit rating, but being included on the Electoral Roll boosts your rating!

13. Does being on the Electoral Roll affect benefits

No. Benefits are not affected by being on or off the Electoral register.

References:

- https://www.experian.co.uk/consumer/guides/electoral-roll.html

- https://www.moneysavingexpert.com/family/electoral-roll-changes/

- General Election 2019: The hidden benefits of registering to vote https://www.bbc.co.uk/news/newsbeat-50329730.

- The electoral register and the ‘open register’: https://www.gov.uk/electoral-register/opt-out-of-the-open-register.

- How to opt-out of the open register – Gwefan Cyngor Sir Gaerfyrddin. https://www.carmarthenshire.gov.wales/home/council-democracy/elections-voting/how-to-opt-out-of-the-open-register/.

- Electoral roll – what are the changes? – MoneySavingExpert. https://www.moneysavingexpert.com/family/electoral-roll-changes/.

- General Election 2019: The hidden benefits of registering to vote https://www.bbc.co.uk/news/newsbeat-50329730.

- The electoral register and the ‘open register’: Opt out of the ‘open register’ https://www.gov.uk/electoral-register/opt-out-of-the-open-register.

- How to opt-out of the open register – Gwefan Cyngor Sir Gaerfyrddin. https://www.carmarthenshire.gov.wales/home/council-democracy/elections-voting/how-to-opt-out-of-the-open-register/.

- Electoral roll – what are the changes? – MoneySavingExpert. https://www.moneysavingexpert.com/family/electoral-roll-changes/.