Renting a house or flat can be daunting, even for the most intrepid renters. Securing the ideal property and scraping together enough cash for a deposit is only the beginning. Next comes the nail-biting stage, when you wait for the landlord’s approval. The landlord will likely ask for references and documents to prove you’re responsible enough to afford the rent you’ve agreed upon. They might even suss out additional information from a third party, such as conducting a rental credit check or tenant credit check through a credit agency – a nerve-wracking ordeal for many renters.

What's Included?

Why do landlords run a rental credit check for tenants?

Landlords need to be confident that they’ll get paid their rent when they let out a property. Credit checks present an opportunity to snoop on tenant history and gather intel on their debt-paying games. A cautious landlord may expect further rent payment issues if there are any County Court Judgements (CCJs) or evidence of insolvent solutions in the tenant’s credit report.

Although once a tenant is in, evicting them can be slow, requiring a written notice of eviction and a ‘possession order’ from the court. Therefore, the landlord must be sure-footed that tenants can afford to pay rent without falling into arrears.

- ⭐ Our 24-Factor Credit Check goes beyond your credit score.

- ⭐ See the problems and solve them.

- ⭐ Personalised steps to improve your credit rating.

See… Fix… Rent… with Credibble.

START FREE TRIALWhat information does a landlord rental credit check reveal?

Landlords are generally savvy and understand how to run a credit check on a tenant. However, before a landlord can perform a tenancy credit check or renter credit check on you, they must first get your written consent. Although, the credit check for tenants they obtain won’t be as comprehensive as those lenders use. The info will include only what’s on public registers like the electoral roll, Individual Insolvency Register, and The Register of Judgments, Orders, and Fines.

What can letting agents see on credit check?

Letting agents and landlords check a tenant’s credit to confirm a tenant’s name, address, past insolvency issues, and CCJs. They won’t be able to access information on credit agreements, limits and repayments. Granted, renters don’t need to agree to a credit check; nonetheless, a landlord may lack confidence in renting without one.

Landlord credit checks for tenants are a necessary part of modern renting.

What other information might a landlord ask for?

When you’re looking to rent a property, take heed: your landlord might ask for more than just a credit check. Be prepared to provide references from previous landlords or employers. And don’t forget to bring along some form of identification to prove you’re legally allowed to live in the UK.

But that’s not all! Sometimes you must also show proof of employment with payslips or a P60. And in some cases, you might even need a Jedi Master – a guarantor – who agrees to pay the rent if you can’t. Typically, this will be a parent or relative with a solid credit history or steady income.

What can you do if a landlord rejects your application?

Unfortunately, credit checks for tenants can also lead to disappointment. If you fail a landlord credit check because of your credit history, it’s a great idea to find out what led to their decision. Sure, you might be able to get feedback from them, but even if you can’t, no sweat; just take a look at your credit report for the full picture.

If you know your credit history is subpar, it’s always best to spill the beans up front. This can save you the hassle and even spare you from wasting money, which can happen if you’re rejected despite coughing up non-refundable agency fees. It could still be possible to rent the property by offering a fatter deposit or using a guarantor.

If you suspect your credit history is the hurdle blocking your way to renting, try to find what’s behind it. Pinpointing those underlying issues can help you bolster your creditworthiness, allowing you to pass the credit check for renting. What’s the additional benefit? Well, you will build bridges to better approval rates from lenders and service providers too.

Can Credibble help with the renting credit check?

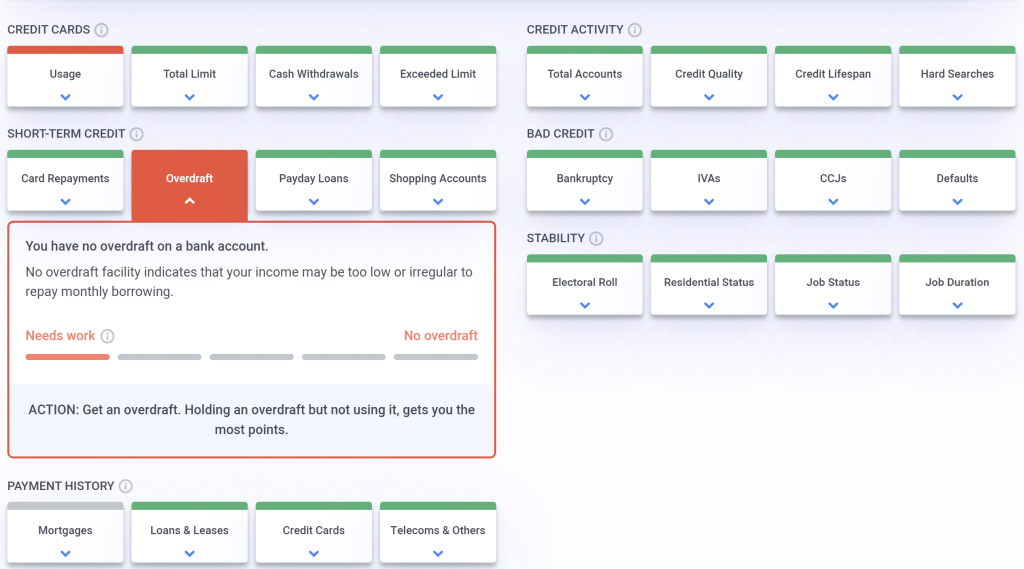

Here at Credibble, we’re helping you take control of your credit score with our innovative 24-Factor Credit Check. Teaming up with the experts at Equifax, our nerdy tech analyses your credit report to give you the most important information – no damage done to your credit rating in the process! Plus, we’re here to flag any red flags on your report and guide you towards fixing them with personalised advice.

With the 24-Factor Credit Check, you’ll get customised action steps based on your report’s changes. So, we’ve got you covered whether you’re in dire straits or looking to cross that credit rating finish line with flying colours. And before you rent that dream flat, try our free 30-day trial to pass that credit check when renting!

Frequently Asked Questions

1. What is a rental credit check?

A rental credit check is a process that landlords or letting agents use to check your credit history and assess your ability to pay rent on time.

2. What information do landlords look for in a rental credit check?

Landlords look for information such as your payment history and any outstanding debts or bankruptcies.

3. Can landlords charge tenants for rental credit checks?

No, landlords or letting agents shouldn’t force you to pay a fee for a rental credit check. If they do, you can report them to Trading Standards¹.

4. What happens if you fail a rental credit check?

If you fail a rental credit check, explain why you think this might have happened. If you know you can pay the rent, tell your landlord or letting agent¹.

5. Are rental credit checks mandatory in England?

No, rental credit checks are not mandatory in England. However, landlords may require them as part of their tenant screening process³.

6. How long does a rental credit check take?

A rental credit check usually takes between 24-48 hours³.

7. Can I rent without a local credit history in England?

Yes, you can rent without a local credit history in England. However, without one, a landlord may not feel confident renting to that individual².

8. What other information might a landlord ask for besides a rental credit check?

As well as a credit check, a landlord may also ask for references from previous landlords or employers³.

9. Can I get my own copy of my rental credit report?

Yes, you can get your own copy of your rental credit report from any of the three major UK credit reference agencies: Experian, Equifax and TransUnion³.

10. What should I do if I have bad credit but still want to rent?

If you have bad credit but still want to rent, consider getting a guarantor who can co-sign the lease with you¹.

11. How to do a credit check on a tenant? (tenant credit check UK)

Are you a landlord wondering how to do a credit check on a tenant? Well, to check a tenant’s credit, you need to get their permission in writing first. Landlords hope they can get a tenant credit check free. Unfortunately, most, if not all, companies involved charge a fee. Why not check out Mudhut, who provide the type of credit check you need?

12. What can letting agents see on credit check?

Letting agents and landlords will carry out a ‘Soft Search’ which only displays information on your credit report that’s publicly available. For example, if you have CCJs, an IVA or bankruptcy. The ‘soft search’ does not affect your credit score.

13. Do both tenants have to have a credit check?

It’s common for landlords to have all tenants undergo credit checks. They do this to ensure tenants are financially responsible and can pay rent on time each month. But the ultimate decision to require credit checks lies solely with the landlord.

References:

- Checks your landlord or letting agent will make – Citizens Advice. https://www.citizensadvice.org.uk/housing/renting-privately/private-renting/checks-your-landlord-or-letting-agent-will-make/.

- Tenant Letting Checks | Loans and Credit | Equifax. https://www.equifax.co.uk/resources/loans-and-credit/credit-checks-for-renting.html.

- united kingdom – Renting in England without a local credit history https://expatriates.stackexchange.com/questions/6189/renting-in-england-without-a-local-credit-history.