You are probably looking for consolidated debt loans for bad credit because you’re finding it difficult to pay for several types of credit. you might benefit from a debt consolidation loan. This option can make it easier to manage your payments, help you understand your debt more clearly, and potentially lower the interest you have to pay.

Remember that loans to consolidate debt for bad credit isn’t the right choice for everyone, and there are many factors to consider before making a decision. ‘Bad credit loans to pay off debt’ are covered in this guide; you’ll learn what debt consolidation is, how it works, and the options available.

What's Included?

What is debt consolidation?

Debt consolidation means transferring some or all of your current debts from multiple accounts (such as credit cards and loans) to a single account. This involves paying off – and possibly closing – your old accounts using the credit from the new account. Your debt will not vanish but will be consolidated into one account. A low-interest debt consolidation loan can be the solution to reduce your monthly payments, leaving a little more money for other things in your life.

How can I tell if I have Bad Credit?

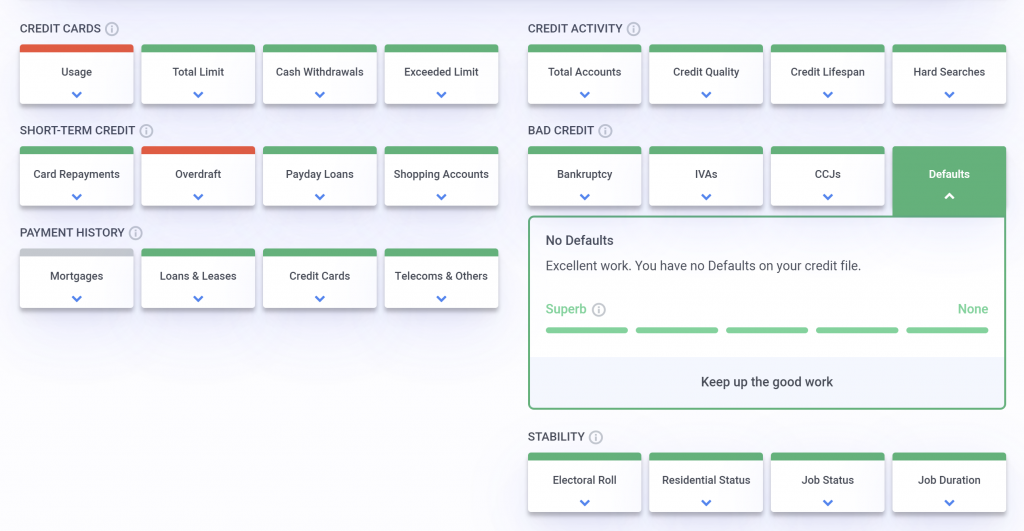

You can use Credibble’s unique 24-Factor Credit Check to find out if you have Bad Credit can affect your ability to borrow. Simply sign up, and you’ll find a dedicated section for credit that brings down your credit rating. You’ll also see personalised steps on how to improve.

You improve your borrowing chances at lower interest rates by fixing the factors holding you back. 24-Factor Credit Check adjusts suggestions to the changes in your credit report, and as it uses Soft Search Technology, it won’t harm your credit rating.

Do I need a credit check?

If you were looking for a ‘no credit check debt consolidation loan’, ‘no credit score loan’ or a ‘debt consolidation loan no credit check’, you’ll nearly always have to face a credit check of some form. No credit check debt consolidation loans would be risky for lenders as they have no idea if you could pay them back. Hence lenders need to assess creditworthiness via a credit check.

How can I get a loan for consolidating debt?

To obtain a consolidated debt loan for bad credit, you must apply and fulfil the lender’s criteria, just like any other type of credit. The lender will evaluate your credit report, application, and records to determine if they will grant you a loan and at what interest rate. Obtaining competitive rates or approval may be challenging if you have a poor credit score. However, there are many measures you can take to boost your rating. Examining your Credibble Score to understand how lenders view you is helpful. It’s the only score where you can use the 24-Factor Credit Check to get personalised insights on improving.

- ⭐ Our 24-Factor Credit Check goes beyond your credit score.

- ⭐ See your credit report through a lender’s eyes.

- ⭐ Personalised steps to improve your credit rating.

See… Fix… Borrow… with Credibble.

START FREE TRIALWhat can debt consolidation loans be used for?

A debt consolidation loan can be used to pay off your current debts, such as credit card debt, personal loan debt, overdraft or store card debt. This way, you only have to focus on paying back the debt consolidation loan instead of various debts.

How do debt consolidation loans work?

Before you apply for a debt consolidation loan, calculate the total amount of your existing debts, including loans, credit card debt, or overdrafts. Apply for a loan with the exact amount you need to pay off all your debts. Once you receive the loan, use the funds to pay off your existing debts. While you still owe the same amount, consolidating your debt will make it easier to manage since it will all be in one place.

After you clear your current debts, you should focus on repaying the loan taken for a consolidated debt loan for bad credit. It is crucial to timely and fully pay off the debt consolidation loan every month. Setting up a Direct Debit from your bank account to the loan provider can help avoid accidentally missing or delaying your monthly payments.

Debt consolidation loans – what to be aware of

- The total cost of the loan

A lower interest rate on a new loan than your existing credit accounts may not necessarily result in lower overall interest payments. This is particularly true if you end up keeping the loan for a much longer period of time.

- Any set-up fee

A fee based on a percentage of the borrowed amount may be applied to establish the loan.

- The impact on your credit score

Your credit score may be negatively affected if you apply for a loan or close old accounts.

Can I consolidate my debt if I have bad credit?

What’s the best It is possible to get a debt consolidation loan with a low credit score using a secured loan. This type of loan is easier to get approved for because it involves using an asset like your house or car as collateral to reduce the lender’s risk. It’s important to note that if you opt for a secured loan, you may lose your asset if you don’t keep up with repayments. Therefore, it’s important to carefully consider before choosing this option. In particular, consolidated debt loans for bad credit can be more expensive, as the interest rate is generally higher.

| Here’s an example of a debt consolidation loan over a 3-year period: | |

| Amount borrowed (over 3 years): | £6,000 |

| Representative APR rate: | 6.1% |

| Annual interest rate: | 6.1% |

| Monthly instalments: | £182.36 |

| Total charge for credit: | £564.86 |

| Total to repay: | £6,564.86 |

Advantages and disadvantages of debt consolidation loans

- By consolidating your debt with a loan, you can enjoy several benefits, such as simpler budgeting, a clearer view of your debt, and potentially lower interest rates. Instead of dealing with multiple payments and statements, you’ll only have to make one monthly payment on a fixed date. Combining all your debt will make it easier to track how much you owe, how quickly you’re making payments and the amount of interest you’re being charged. Additionally, by consolidating your debt, you may obtain lower interest rates, reducing the amount of interest you pay overall.

Some of the disadvantages:

- Not your full and timely repayments every month can hurt your credit score. Additionally, if you terminate your credit agreement early, your current lenders may charge you a fee. If you fail to repay a secured debt consolidation loan (typically secured against your home or car), you risk losing the asset that secures the loan.

What kinds of debt consolidation loans are available?

There are two main types of debt consolidation loans available:

Secured debt consolidation loans

To qualify for this debt consolidation type, you must have equity in one or more properties because the loan will be secured against it. Secured debt consolidation loans have two advantages over non-secured loans: borrow a larger amount and get a lower interest rate. However, failing to keep up with repayments and defaulting on the loan could result in losing your home.

Unsecured debt consolidation loans

You don’t need to own a home to qualify for this loan. However, your credit history and ability to repay the loan are the primary factors determining whether you qualify for an unsecured debt consolidation loan. A poor credit score may make it difficult for you to get approved for a loan. Even if approved, you may not be able to borrow as much as others and may have to pay a higher interest rate.

So does having bad credit make a difference?

So what’s the best debt consolidation loan for bad credit? Let’s take a look.

Sometimes our research shows people searching ‘debt loans for bad credit’, ‘loans for debt bad credit’ or even ‘loan to pay off debt bad credit’ for consolidated debt loans for bad credit. Ultimately, it’s the same issue – you’ve had a poor run with your finances and low credit rating. Loans to pay off debt with bad credit will push you towards an unsecured loan. However, if you can get an unsecured loan, as explained, the interest rate will generally be much higher – you’ll pay relatively more to borrow.

What are my alternatives to a debt consolidation loan?

Balance transfer credit cards

To consolidate credit card debt, consider transferring it to a 0% balance transfer card. This will simplify payments, and you won’t be charged interest for a particular period. There are a few things to keep in mind, though. Firstly, there may be an initial balance transfer fee.

Additionally, you must pay at least the minimum monthly payment on time and in full to keep the promotional rate. Lastly, once the promotional period ends, you will usually be charged the company’s standard rate. Repaying the card before the period ends is the best way to avoid paying interest. Note if you close your old credit cards, it could harm your credit score.

Negotiating directly with your lenders consolidated debt loans for bad credit

A recommended option is to contact your lenders directly to inform them about your payment difficulties and explore available options. Taking this step promptly rather than waiting to miss payments or default on your account is advisable.

If you default on a payment, companies may struggle with collecting your money. They might accept a lowered payment or forgive penalty fees to avoid this. However, please note that reduced payments will be noted in your credit report, adversely affecting your credit score. Additionally, it may take you longer to pay off your debt.

Speaking to debt charities

As you can tell, you’ll use consolidated debt loans for bad credit if you’re struggling to pay off your debts. However, be careful of companies that promise to eliminate them for a fee. These companies may charge high fees, resulting in additional debts or harm your credit score.

It is typically better to seek help and advice for debt consolidation from a trustworthy non-profit organisation like StepChange or National Debt Line. These organisations can guide you in managing your debt by suggesting options like a debt management plan or an Individual Voluntary Arrangement. However, these solutions may harm your credit report and score.

Frequently Asked Questions

1. Are debt consolidation loans harder to get?

Qualifying for a debt consolidation loan is possible even with bad credit. In fact, a debt consolidation loan may be one of the best loans for bad credit in the UK. However, your choices may be slightly more limited 1.

2. How can I get out of debt with bad credit and no money?

There are several ways to get out of debt with bad credit and no money. You can consider getting a debt consolidation loan, which can help you combine debts into one manageable loan ⁵. You can also consider contacting a debt charity such as StepChange or National Debtline for free advice on managing your debts.

3. Do they check credit for debt consolidation?

Lenders will check your credit score when you apply for a debt consolidation loan. However, there are lenders who specialise in providing loans to people with bad credit ².

4. Are there any disadvantages to consolidating debt?

Consolidating your debts can help you manage your finances more effectively by combining all your debts into one monthly payment. However, there are some disadvantages to consolidating debt. For example, you may pay more interest over the long term if you consolidate your debts into a longer-term loan ³.

5. Why can’t I get a loan to consolidate debt?

If you’re struggling to get a loan to consolidate your debts, it may be because you have a poor credit score or too much-existing debt ².

6. How can I clear my debts with one loan?

You can clear your debts with one loan by getting a debt consolidation loan. This type of loan allows you to move one or more of your existing debts into one place to make it more manageable ⁵.

7. How much debt do you need to consolidate?

There is no minimum amount of debt required to consolidate your debts. However, it is generally recommended that you only consolidate debts with high-interest rates or difficult to manage ³.

8. How long does debt consolidation stay on your credit report?

Debt consolidation will stay on your credit report for six years from the last payment date.

9. What are the disadvantages of consolidation?

Consolidating your debts can help you manage your finances more effectively by combining all your debts into one monthly payment. However, there are some disadvantages to consolidating debt. For example, you may pay more interest over the long term if you consolidate your debts into a longer-term loan ³.

10. Can I still use my credit card after debt consolidation?

Yes, you can still use your credit card after consolidating your debts. However, avoiding using your credit card until you have paid off your consolidated debts is generally recommended 2.

11. How to get out of 30K credit card debt?

There are several ways to get out of 30K credit card debt, such as a balance transfer card with a 0% interest rate for an introductory period or a personal loan with a lower interest rate than the current rate on the card. For such a large amount, a combination of solutions will probably be needed. Loans for bad credit to pay off debt in this situation will carry higher rates of interest.

12. How do I get out of extreme debt?

You can get out of high debt by creating a budget and sticking to it, contacting creditors and negotiating payment plans or settlements and seeking professional help from organisations such as StepChange or National Debtline.

13. What is a hardship loan?

A hardship loan is a type of personal loan designed for people experiencing financial hardship due to unexpected expenses or other financial difficulties.

14. Do credit card companies ever forgive debts?

Credit card companies may forgive some or all of your outstanding balance if they believe it is unlikely they will be able to recover the full amount owed.

15. What debts affect your credit score?

Various types of debts can affect your credit score including mortgages, personal loans, student loans and credit cards 4.

16. What is debt relief program?

A debt relief program is designed to help people who are struggling with unmanageable levels of debt by providing them with financial assistance and support 5.

17. Does debt consolidation affect your credit score

Yes, debt consolidation can affect your credit score. It can have either a positive or negative impact depending on how you apply for debt consolidation, how you repay your debts and what your credit score was to begin with, among other factors.

References:

- Can I Get a Debt Consolidation Loan with Bad Credit in the UK?. https://www.thesecondmortgagecompany.co.uk/news/can-i-get-debt-consolidation-loan-bad-credit-uk.

- Debt Consolidation Loans UK | Personal Loans | Post Office. https://www.postoffice.co.uk/personal-loans/debt-consolidation-loans.

- Debt consolidation loans – How do they work? | Uswitch. https://www.uswitch.com/loans/debt-consolidation-loans/.

- Compare debt consolidation loans | MoneySuperMarket. https://www.moneysupermarket.com/loans/debt-consolidation-loan/.

- Compare Our Best Debt Consolidation Loan | June 2023 | money.co.uk. https://www.money.co.uk/loans/debt-consolidation-loans-unsecured.