If you’re reading this, you’re probably contemplating a new mobile phone contract or maybe failed an ‘o2 credit check’ or ‘three credit check’. Whatever has led you to this moment, know you’re not alone! The mobile phone credit check can be tricky, and there’s always a risk of being declined if the credit check shows your credit rating isn’t up to snuff. This doesn’t mean you will be stuck with that old phone, so don’t fret just yet. Whether you’ve failed the mobile phone credit check or trying to get a mobile phone with bad credit – we have you covered.

Most networks and providers use credit checks to ensure customers can afford their monthly payments and to protect against fraud. In this guide, we’ll delve into why you could be declined for that plum deal you’re after, and more importantly, we’ll offer you insider tips on how to successfully ace that mobile phone credit check. So sit back, relax, and prepare to become a mobile phone credit check pro!

What's Included?

Why would I fail a mobile phone credit check?

Your credit report is the key to most declines. Here are the top 8 reasons for failing a mobile phone credit check:

Late payments

Late payments are a common issue for lenders, and can negatively impact your chances of being approved for certain applications. When you miss a scheduled monthly payment, it is considered a late payment and can be a red flag for lenders. As you can imagine, previous mobile phone accounts with late payments may be especially harmful to your chances. Some lenders are more lenient with late payments than others, but staying on top of them is important to avoid future issues.

Missed Payments and Arrears

Arrears are consecutive missed payments for two months or more – i.e. you still owe money. For instance, 2 consecutive missed payments will be considered as being in arrears for 2 months, and 3 missed payments will result in three months of arrears. It’s worth noting that arrears are viewed as more severe than a single late payment when applying for a mobile phone contract. This makes getting accepted even trickier.

Defaults

Defaults are a major red flag on your Credit Report, indicating that your account was closed down by a lender due to prolonged non-repayment. These negative markers indicate ‘high risk’ and can complicate securing a mobile phone contract. Phone providers tend to avoid or charge higher repayment amounts from customers with defaults to offset the risk. Defaults will significantly harm your creditworthiness for a six-year period from the default date – but during this time, their effect on your credit rating fades.

County Court Judgments

County Court Judgments (CCJs) can severely affect your creditworthiness and jeopardise your chances of getting approved for a mobile phone. CCJs are issued by a lender as a last resort to recover owed money, as the legal process to obtain them is both time-consuming and fairly expensive. As a result, mobile phone companies tend to favour applicants without Court Records since they are perceived as posing a high risk level.

Bankruptcies

Bankruptcies and insolvencies don’t hold the same restrictions for mobile phone contracts as other forms of finance. However, it’s important to note that bankruptcy or insolvency on your credit report creates a red flag and perceived risk, making it tough to attain a mobile phone or any other account.

Not registered to vote

Declining to register to vote? An Electoral Roll listing is a powerful record of your residential stability and ID verification. Mobile phone providers and other companies use this info while screening your application to know who they are doing business with and where to find them to recover any missed payments.

Bad financial associations

You know what they say, “You’re judged by the company you keep”. Financial Associations are individuals, whether spouses, partners, friends, or family members, with whom you’ve had a credit link. Even flatmates and shared bank account holders count. Did you know their poor credit rating can affect your rating too? If your financial associations are no longer active, you can request them removed from your credit file.

Mistakes on your credit file

Keeping a keen eye on your credit file is crucial, as it’s not uncommon for it to contain errors. Regular monitoring offers the quickest way to enhance your credit rating and score. By law, Credit Reference Agencies must respond to queries within 28 days. So, make sure to act swiftly to set things straight!

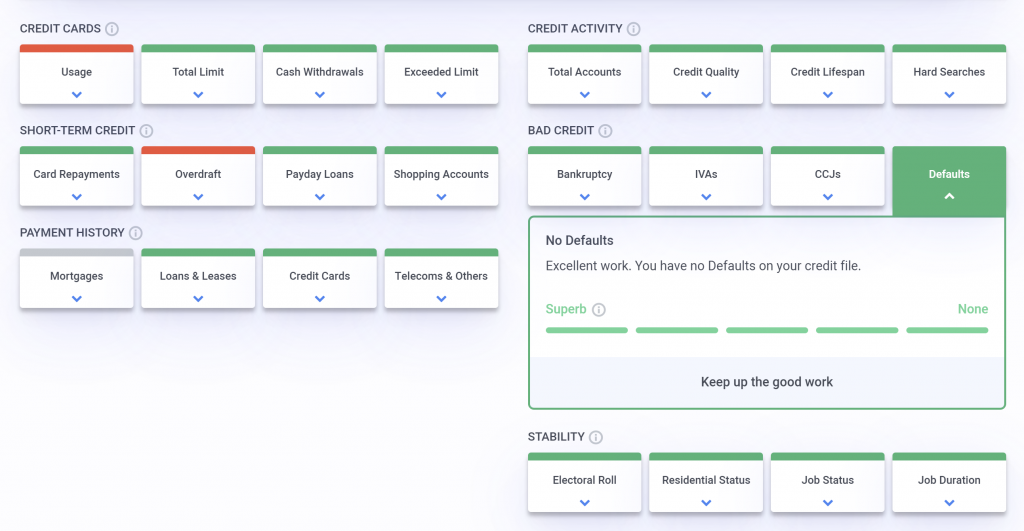

Credibble’s unique 24-Factor Credit Check lets you easily determine whether your bad credit history can affect your mobile phone application before you apply. As it uses Soft Search Technology and won’t harm your credit rating.

There’s a section for Bad Credit and personalised steps on how to improve. By fixing the factors that hold you back, you can greatly enhance your chances of getting approved for a new phone.

Even better, the 24-Factor Credit Check adjusts its suggestions according to the changes in your credit report. So the guidance it provides is always up-to-date and tailored to your needs. Credibble is the perfect solution for anyone looking to improve their credit rating and get the phone they want. Why not take a 30-day free trail and see the problems your credit score is hiding?

Have a good credit score but declined phone contract?

Credit scores and credit ratings significantly impact mobile phone approvals, but other factors must be the problem too. Service providers evaluate various factors before approving a contract. Let’s dive in and uncover some of the other big factors.

Stability: Income and employment status

Notice the emphasis on STABILITY. A mobile phone provider will only give a contract if they feel convinced you will make timely and full payments. As part of this, they will carefully consider your income and employment status. Your income should be sufficient to cover the payment terms that you have agreed on, and you should have a consistent employment record.

Financial commitments

Financial commitments might impact your mobile phone provider’s decision to offer payment terms that best serve you. To avoid placing customers into monthly contracts, they can’t keep up with; providers are responsible for making profits and keeping clients’ financial wellness in check. So it’s worth considering your existing obligations before signing up for new ones.

Upfront deposit

Mobile phone providers provide this option because an instant, guaranteed payment lowers the risk from their perspective. And likewise, providers are inclined towards upfront fees as it reduces the amount they need to wait to receive. The riskier they feel you are, the more you’ll need to pay upfront to seal the deal.

Length of contract

As with the upfront payment, the length of a mobile phone contract can be personalised to fit your budget. If you opt for a short contract, the monthly payment will increase since you’ll pay off the full device cost in a shorter period. However, mobile phone deals with zero upfront cost and shorter contract lengths may elevate your monthly burden. Typically, the higher the monthly payment, the stricter mobile phone providers are when approving applications.

I failed a mobile phone credit check – should I apply again?

It may be tempting to reapply for that mobile contract straight away. The bad news, using the same info and phone number will likely yield the same outcome. It’s crucial to bear in mind how reapplying for any credit can impact your credit rating, including mobile phone contracts. Every time you apply, a hard search (known also as a ‘hard check’) gets recorded on your credit report. Too many credit applications in a brief period could adversely affect your credit score, as it implies other firms are declining you. In other words, it makes you look like a high-risk customer, desperate for credit.

- ⭐ Our 24-Factor Credit Check goes beyond your credit score.

- ⭐ See your credit report through a lender’s eyes.

- ⭐ Personalised steps to improve your credit rating.

See… Fix… Borrow… with Credibble.

START FREE TRIALHow to avoid failing the mobile phone credit check?

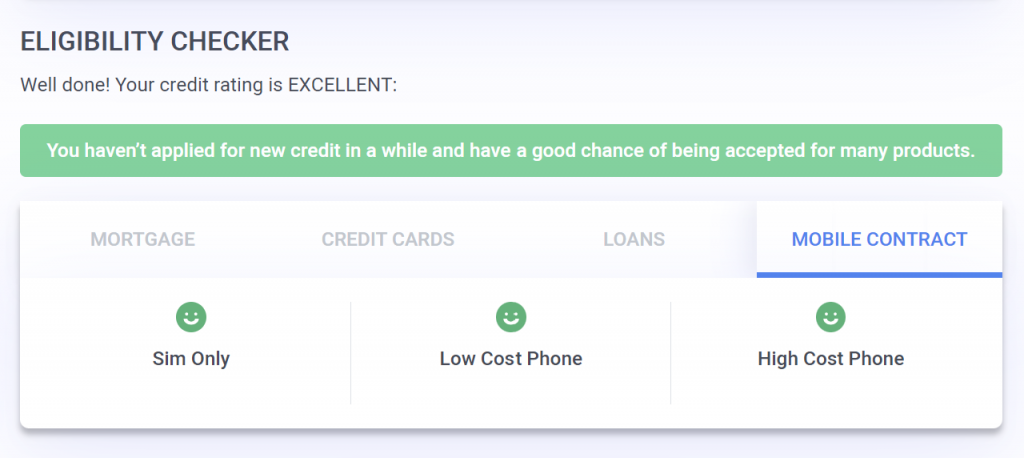

Credibble’s built-in Eligibility Checker analyses your credit report for everything from credit cards to personal loans, mortgages and mobile phone contracts— all without adversely affecting your score! It uses Soft Search Technology meaning your credit rating won’t be impacted unless you decide to apply. If your credit rating isn’t up to scratch for the deal you want, Credibble’s 24-Factor Credit Check is on hand to help you rebuild your credit and get your ready for that mobile phone credit check.

Can I get a mobile phone with bad credit?

It is possible to secure a mobile phone contract even with a low credit score. However, it is crucial to note that the chances of being accepted may be more challenging than for someone with a high rating – seemingly easy to get phone contracts may not be so easy. Even if your credit score is good, there is no assurance of a successful application. Each mobile phone company will have unique criteria for accepting customers. Hence you’ll hear stories of ‘good credit score but declined phone contract’ circulating on the internet because there isn’t a perfect phone contract credit score.

In most cases, the latest smartphones with costly contracts require a mobile phone credit check, meaning that the health of your credit report will play a crucial role in your application process. It’s essential to note that some organisations offer mobile phone contracts without credit checks. Nonetheless, a SIM only contract (no free handset), that doesn’t require a credit check, may be limited to small data plans and can be more progressively costly. They offset the risks of accepting customers by not performing a credit check first.

You can get a mobile phone contract even with bad credit. However, it’s crucial to be aware that being accepted may be more challenging, and high-end smartphones with more expensive contracts require credit checks.

What are my other options if I’m rejected?

Regrettably, any financial contract is a binding commitment. So, hold your horses before committing yourself – especially if you’re struggling financially. The good news is you might want to consider other options. That way, you can secure your latest phone or grab an upgrade.

Pay an upfront deposit

When you apply for a contract with a network provider, your poor credit history might prompt them to ask for a deposit upfront. This deposit acts as insurance for the provider in the event you fail to make payments, thus offsetting their risk. Remember that the deposit amount required depends on your creditworthiness, the package you choose, and the provider you go with.

To recover your deposit, ensure you make payments regularly, usually for a minimum of three to twelve months. By keeping up with your payments, you’ll also build a good credit score, ultimately qualifying for even better deals in the future.

Choose a pay-as-you-go deal

If you’re not big on phone usage, a pay-as-you-go service could be your go-to. With this option, purchase a phone upfront and pay for credit when necessary. No contract will tie you down, nor will you have to worry about credit checks!

Choose a SIM-only deal

Instead of going for pricey phone contracts, why not consider SIM-only deals? With a SIM-only tariff, you only pay for data, calls, and texts – no phone included. Because of the cheaper overheads, chances are you’ll be accepted, and payments will be lower. But remember, always make prompt payments to improve your credit score over time.

Choose a ‘bad credit’ phone contract

If you’re dealing with a low credit score, you can still get a mobile phone contract through specialist providers. It’s important to note, though, that you may have to settle for a less popular phone model and shell out more monthly money for this kind of contract.

Explore Family deals

Opt for a family plan wherein several phone lines could be connected to one contract with only one bill and a single credit check. You can ask a family member possessing a decent credit rating to sign up.

Get a guarantor

Obtaining a guarantor is one way to sign a contract. They’ll have a good credit rating and assume the responsibility for your debt if you can’t muster the means to pay it. It’s important to note that the guarantor will be held accountable for any missed payments, reducing the risk for the network provider in case you don’t pay. On the plus side, consistent and timely payments can result in an incremental improvement of your own credit rating.

Frequently Asked Questions

Can I get a phone plan with low credit?

Yes. A pre-paid mobile phone plan (pay as you go) doesn’t need a credit check and is thus an excellent option for people with bad credit.

What is an ‘upfront cost’?

When subscribing to monthly phone contracts, paying an upfront cost of £50-£200 is common. This typically applies to newer, top-of-the-range smartphones. Although it may seem like a burden, consider it an investment in gaining access to the latest mobile technology.

Where can I get a phone contract with bad credit?

Despite having a low credit score, It is possible to obtain a contract phone from providers, such as Swift Contract Phones and Denied.co.uk for bad credit mobile phones. However, remember that you may not be eligible for the latest device or the most rewarding plan. One way to bolster your credit score is to pay off a SIM-only contract over a period of 12 months. Alternatively, there are other credit-boosting methods you could also consider!

Does contract phone build credit?

Mobile phone contracts are not in the scope of The Consumer Credit Act? This allows providers to decide whether or not to report an account as being in default to credit reference agencies in the UK. Even so, paying your bills punctually and completely every month can boost your credit score. Keep the payments reliable, and your financial status will thank you!

Do Tesco Mobile do credit checks?

The no-contract SIM doesn’t involve a credit check, but you must have money on the SIM.

What is the minimum credit score for mobile phone contract UK?

A mobile phone contract in the UK usually involves a mobile phone credit check. However, phone networks are among the most forgiving contracts, even with a poor credit history. Remember, it’s in their interest to give you that brand new phone.