Your credit score is not the be-all and end-all. Your creditworthiness is decided on a number of factors, some of which may surprise you. At Credibble, we don’t just offer you a credit score, we offer you a 24-Factor Credit Check. With the 24-FCC you get to see the factors that lenders use to decide if they trust you to borrow from them. This way, you can tell at a glance what needs changing and what needs to stay the same.

What's Included?

Your Creditworthiness

Your credit score is only a small piece of the puzzle. While it can give you an immediate sense of how your credit report looks to lenders, it doesn’t tell you the fine details. We’ve already established in a previous article that lenders don’t use credit scores to determine whether to lend to you. Instead, they use their own internal algorithms, which is the basis for the 24-FCC.

What lenders really want to know is how creditworthy you are. In other words, they want to know to know if they can trust you to pay back what you borrow. To find that out, they have to go off your track record of managing debt.

The more creditworthy you are, the greater access you have to credit. Not only are your chances of approval that much greater, but you’ll also get better deals as well.

Remember: It’s not just bad credit that looks bad to lenders, it’s a lack of credit history. If there are too many unknowns, then lenders won’t want to lend large sums of money to you. At least, not without a few caveats.

Your Credibble Score

We calculate your Credibble Score by examining your credit report from Equifax. Equifax is one of the UK’s three main Credit Reference Agencies. We use this report to calculate a number out of 1000. This is your Credibble Score.

Your Credibble Score summarises your creditworthiness in a single, easy-to-understand number. Right away, you can see where you are and what targets you need to meet.

After we’ve calculated your Credibble Score, we give you your Credit Report. This is where the 24-FCC comes in.

24-Factor Credit Check (24-FCC)

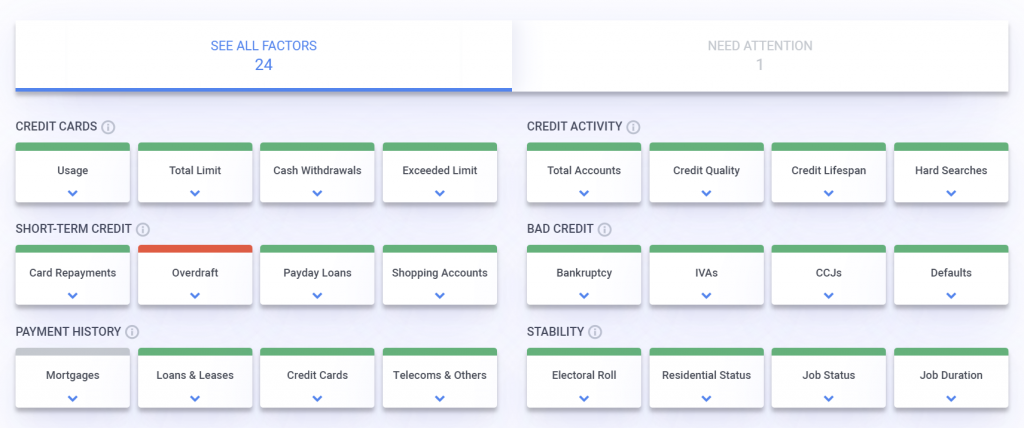

The 24-Factor Credit Check turns your Credit Report into an set of goals. It’s easy-to-read and easy-to-understand.

The 24-FCC consists of six Credit Factors, each of which contains four Sub-Factors. This lets you get into the nitty-gritty right away. The modular visual design shows you exactly where your points of improvement are. This includes a “traffic-light” colour-coding system for each of the Sub-Factors.

The six Credit Factors are:

At the click of a button you can highlight the Sub-Factors that need attention. This lets you know right away what you could be doing to improve your creditworthiness. Each problematic Sub-Factor presents you with a solution, called a Credit Fix.

As you make Credit Fixes, the Sub-Factors will change colour. Red indicates the lowest level of creditworthiness, and these will likely be your main focus in building a better Credit Report. Improved red Sub-Factors turn yellow, indicating middling creditworthiness. Once you have fixed all your yellows, the Sub-Factor will change to green, indicating a high likelihood of credit approval.

Below the 24-FCC, there is also an interface showing you your Credit Options. This gives you insight into your approval odds for different forms of credit. This helps you avoid unsuccessful applications, which could damage your credit rating.

Credibble offers two fabulous solutions

If you’re preparing to take a mortgage, never apply until you’ve tried our unique and FREE Credibble Home app. Our smart technology will tell you what you need to fix so you avoid rejection. The app predicts when you will be able to buy, for how much and tracks your month-by-month progress to mortgage success. We’ve even added your own mortgage broker, so you get the best deals available.

More focused on your credit rating? Well, get started for free with Credibble’s 24- Factor Credit Check to truly help you improve your creditworthiness and how lenders view you. (Remember: lenders don’t use your credit score! We’ll show you what lenders look for and how to get your credit report in the best shape possible).